All Categories

Featured

IUL contracts protect against losses while offering some equity threat costs. IRAs and 401(k)s do not use the same drawback protection, though there is no cap on returns. IULs have a tendency to have have complicated terms and higher charges. High-net-worth individuals wanting to decrease their tax obligation problem for retired life might gain from spending in an IUL.Some investors are far better off buying term insurance while maximizing their retirement contributions, instead of acquiring IULs.

While that formula is linked to the efficiency of an index, the quantity of the credit score is almost always going to be less.

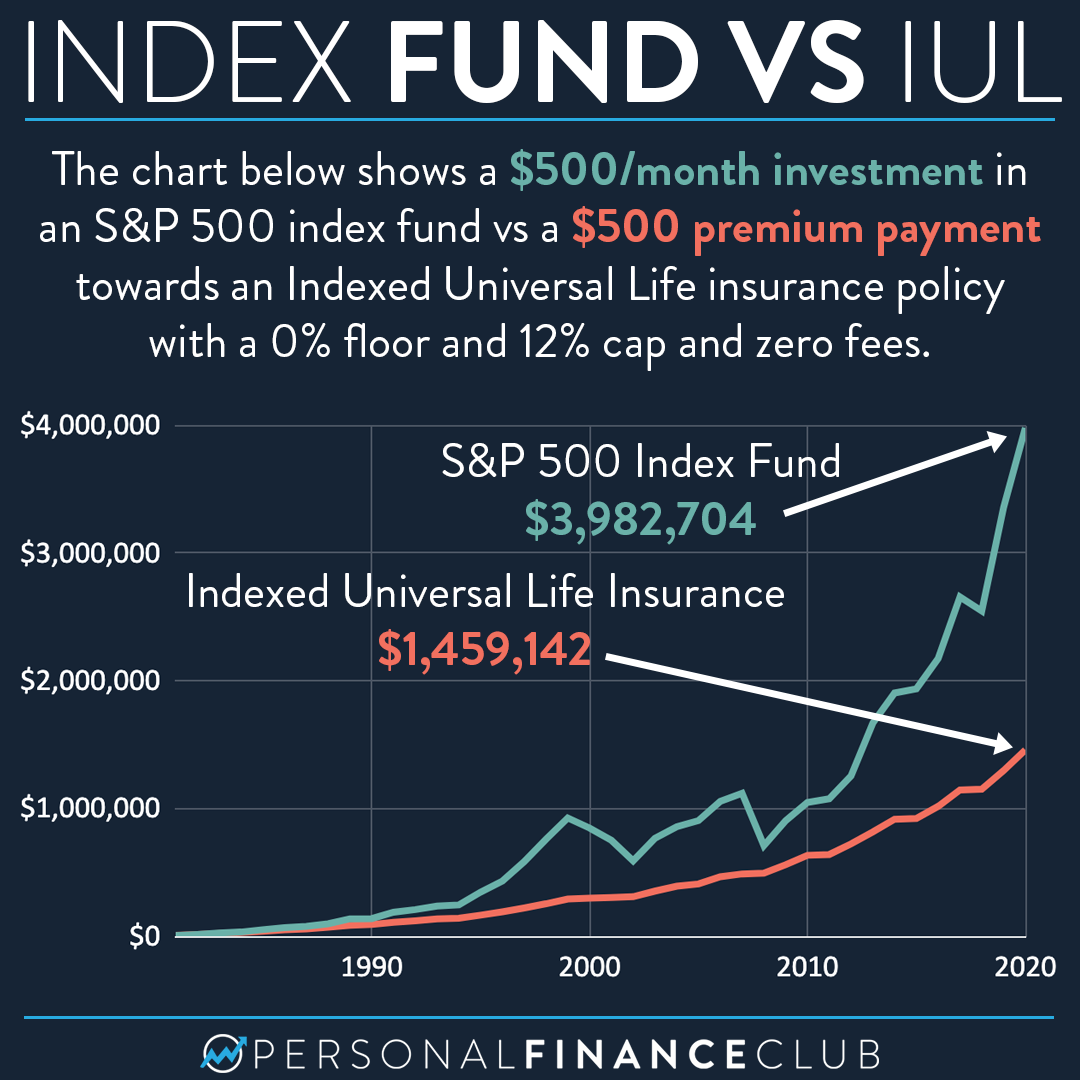

With an indexed universal life plan, there is a cap on the quantity of gains, which can limit your account's development. If an index like the S&P 500 increases 12%, your gain can be a portion of that quantity.

Transamerica Iul 7702

Unalterable life insurance policy counts on have long been a popular tax obligation shelter for such people. If you come under this classification, think about talking with a fee-only monetary expert to discuss whether purchasing long-term insurance coverage fits your total technique. For several financiers, however, it might be better to max out on payments to tax-advantaged pension, specifically if there are contribution matches from an employer.

Some plans have actually a guaranteed price of return. One of the crucial features of indexed universal life (IUL) is that it provides a tax-free distributions.

Property and tax diversity within a profile is raised. Pick from these products:: Provides long-lasting growth and income. Suitable for ages 35-55.: Offers flexible coverage with modest cash value in years 15-30. Ideal for ages 35-65. Some points customers should take into consideration: In exchange for the survivor benefit, life insurance policy items bill costs such as death and expense threat costs and surrender fees.

Retirement planning is important to keeping economic safety and security and keeping a specific standard of life. of all Americans are fretted about "maintaining a comfy standard of living in retirement," according to a 2012 study by Americans for Secure Retirement. Based on recent stats, this bulk of Americans are justified in their worry.

Department of Labor estimates that a person will certainly need to maintain their present requirement of living when they begin retirement. In addition, one-third of united state homeowners, in between the ages of 30 and 59, will not have the ability to maintain their requirement of living after retirement, even if they delay their retirement until age 70, according to a 2012 research by the Staff member Benefit Research Institute.

Iul Vs 401k Savings Strategy

In 2010 greater than 80 percent of those in between age 50 and 61 held financial obligation, according to the Social Protection Management (SSA). The average financial debt quantity among this age team was greater than $150,000. In the same year those aged 75 and older held an ordinary financial obligation of $27,409. Amazingly, that figure had more than doubled since 2007 when the average debt was $13,665, according to the Employee Advantage Research Institute (EBRI).

Census Bureau. 56 percent of American retirees still had superior debts when they retired in 2012, according to a study by CESI Debt Solutions. What's worse is that previous research has actually shown financial debt amongst retirees has gotten on the rise throughout the previous couple of decades. According to Boston University's Center for Retired life Research, "In between 1991 and 2007 the number of Americans in between the ages of 65 and 74 that submitted for personal bankruptcy enhanced an amazing 178 percent." The Roth Individual Retirement Account and Plan are both devices that can be made use of to develop significant retired life savings.

These financial tools are comparable in that they profit insurance holders that desire to generate cost savings at a reduced tax obligation price than they may run into in the future. The policy expands based on the passion, or returns, attributed to the account - wrl financial foundation iul.

That makes Roth IRAs excellent cost savings vehicles for young, lower-income workers that stay in a reduced tax brace and who will gain from decades of tax-free, compounded growth. Because there are no minimum called for payments, a Roth individual retirement account offers capitalists manage over their personal goals and risk tolerance. Additionally, there are no minimum called for circulations at any type of age during the life of the plan.

To contrast ULI and 401K plans, take a minute to recognize the essentials of both products: A 401(k) allows staff members make tax-deductible contributions and enjoy tax-deferred growth. When employees retire, they typically pay taxes on withdrawals as common income.

Iscte Iul

Like other permanent life plans, a ULI plan additionally designates component of the costs to a money account. Considering that these are fixed-index plans, unlike variable life, the policy will also have actually an assured minimum, so the cash in the cash account will certainly not decrease if the index decreases.

Policy proprietors will likewise tax-deferred gains within their cash account. 401k vs indexed life insurance. Explore some highlights of the advantages that universal life insurance can use: Universal life insurance plans do not enforce limitations on the size of plans, so they might supply a method for staff members to conserve even more if they have currently maxed out the IRS limits for other tax-advantaged economic products.

The IUL is much better than a 401(k) or an individual retirement account when it pertains to conserving for retirement. With his almost 50 years of experience as an economic planner and retirement preparation professional, Doug Andrew can show you specifically why this holds true. Not only will Doug discusses why an Indexed Universal Life insurance policy contract is the far better car, yet also you can also discover exactly how to optimize assets, lessen tax obligations and to equip your genuine wide range on Doug's 3 Dimensional Wide range YouTube network. Why is tax-deferred buildup less desirable than tax-free build-up? Discover exactly how putting things off those tax obligations to a future time is taking a terrible danger with your savings.

Latest Posts

Iul Life Insurance Vs Whole Life

Iul Benefits

My Universal Insurance