All Categories

Featured

Table of Contents

It is very important to keep in mind that your cash is not directly purchased the stock exchange. You can take cash from your IUL anytime, yet costs and give up charges may be linked with doing so. If you require to access the funds in your IUL plan, considering the pros and cons of a withdrawal or a financing is crucial.

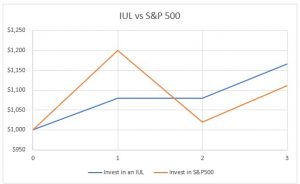

Unlike direct investments in the securities market, your cash worth is not straight invested in the underlying index. iul 是 什么. Rather, the insurance provider uses economic tools like choices to link your cash money worth development to the index's efficiency. Among the special functions of IUL is the cap and floor rates

Upon the insurance policy holder's death, the recipients obtain the death advantage, which is normally tax-free. The death advantage can be a set quantity or can consist of the cash money worth, depending upon the policy's framework. The cash value in an IUL plan expands on a tax-deferred basis. This means you don't pay tax obligations on the after-tax resources gains as long as the cash continues to be in the plan.

Constantly assess the policy's information and speak with an insurance specialist to fully understand the advantages, limitations, and costs. An Indexed Universal Life insurance policy plan (IUL) offers an one-of-a-kind mix of attributes that can make it an eye-catching alternative for specific individuals. Here are several of the vital advantages:: Among one of the most enticing facets of IUL is the possibility for greater returns compared to other sorts of long-term life insurance coverage.

Taking out or taking a funding from your plan might reduce its cash money value, survivor benefit, and have tax implications.: For those interested in tradition planning, IUL can be structured to provide a tax-efficient means to pass wide range to the next generation. The fatality advantage can cover estate tax obligations, and the money worth can be an extra inheritance.

Symetra Iul

While Indexed Universal Life Insurance Coverage (IUL) uses a range of advantages, it's vital to take into consideration the possible disadvantages to make an educated decision. Right here are several of the essential disadvantages: IUL policies are extra complex than traditional term life insurance policy policies or entire life insurance policy policies. Comprehending how the money value is linked to a securities market index and the ramifications of cap and floor prices can be challenging for the typical customer.

The costs cover not just the expense of the insurance coverage but likewise management charges and the financial investment part, making it a pricier alternative. While the cash money worth has the capacity for development based upon a stock exchange index, that development is frequently capped. If the index does exceptionally well in a provided year, your gains will be limited to the cap rate defined in your plan.

: Adding optional functions or cyclists can boost the cost.: Exactly how the plan is structured, consisting of exactly how the money worth is alloted, can also influence the cost.: Different insurance provider have different rates versions, so shopping about is wise.: These are fees for taking care of the plan and are typically subtracted from the money worth.

Iul Or Roth Ira: Which Is Right For Your Financial Future?

: The expenses can be similar, however IUL provides a flooring to help secure versus market recessions, which variable life insurance policy plans generally do not. It isn't easy to give an exact expense without a specific quote, as rates can vary considerably in between insurance policy providers and individual scenarios. It's crucial to stabilize the value of life insurance policy and the demand for included security it provides with potentially higher premiums.

They can assist you comprehend the costs and whether an IUL plan lines up with your monetary goals and requirements. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and relies on your economic goals, risk tolerance, and long-lasting planning demands. Right here are some points to think about:: If you're seeking a long-lasting financial investment car that supplies a survivor benefit, IUL can be a great alternative.

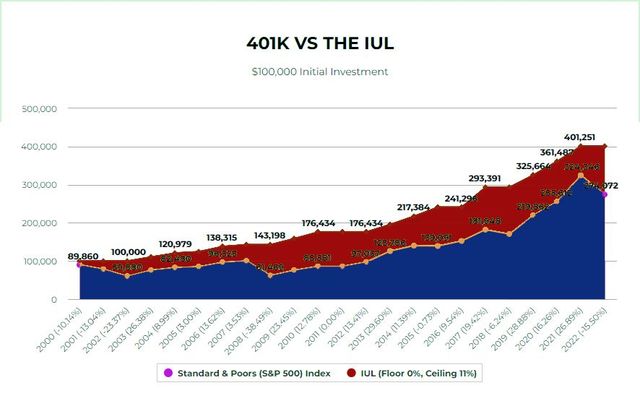

The most effective time to start planning for your lasting economic future is now. 2 of the most effective methods you can do that is by buying a retirement, like 401(k), and an Index Universal Life Insurance Policy (IUL) plan. Comprehending the distinction between IUL vs. 401(k) will help you intend efficiently for retirement and your household's financial well-being.

Www Iul Edu Lb

In this instance, all withdrawals are tax-free given that you have actually already paid tax obligations on that particular revenue. When you die, the funds in your 401(k) account will be transferred to your recipient. If you do not assign a recipient, the cash in your account will become component of your to repay any kind of arrearage.

You might expand your Roth IRA account and leave all the money to your beneficiaries. On top of that, Roth IRAs offer even more financial investment alternatives than Roth 401(k) plans. Unfortunately, your only choices on a Roth 401(k) strategy are those provided by your plan company with.The drawback of a Roth individual retirement account is that there's an income limitation on who can add to an account.

This isn't an attribute of a Roth individual retirement account. Given that 401(k) plans and Index Universal Life Insurance function differently, your cost savings for every depend upon distinct variables. When contrasting IUL vs. 401(k), the primary step is to comprehend the general objective of retired life funds contrasted to insurance advantages. Your retirement funds need to have the ability to sustain you (and your partner or family members) for a couple of years after you quit working.

You need to estimate your retired life needs based on your current earnings and the requirement of living you want to maintain during your retired life. Typically, the price of living doubles every 20 years.

We wish to introduce right here to make the estimation less complicated. If you withdraw about 4% of your retirement earnings yearly (thinking about rising cost of living), the funds need to last concerning three decades. On the other hand, when comparing IUL vs. 401(k), the value of your Index Universal Life Insurance policy depends upon elements such as; Your current revenue; The estimated cost of your funeral service expenditures; The size of your household; and The earnings streams in your home (whether somebody else is used or otherwise). The even more beneficiaries you want to sustain, the more money should go towards your survivor benefit.

Life Insurance Vs. A 401(k): Weighing The Pros And Cons

In truth, you do not have much control over their appropriation. The primary objective of irreversible life insurance policy is to provide additional monetary assistance for your household after you pass away. Although you can withdraw cash from your money value make up individual requirements, your insurance coverage carrier will certainly subtract that quantity from your death advantages.

You can have both an Index Universal Life Insurance coverage plan and a 401(k) retired life account. You should recognize that the terms of these policies change every year.

All set to get started?!! I'll respond to all your concerns regarding Index Universal Life Insurance and just how you can achieve wide range before retirement.

Table of Contents

Latest Posts

Iul Life Insurance Vs Whole Life

Iul Benefits

My Universal Insurance

More

Latest Posts

Iul Life Insurance Vs Whole Life

Iul Benefits

My Universal Insurance